E Filing 2016

Click the login to e filing account button to pay any due tax intimated by the ao or cpc.

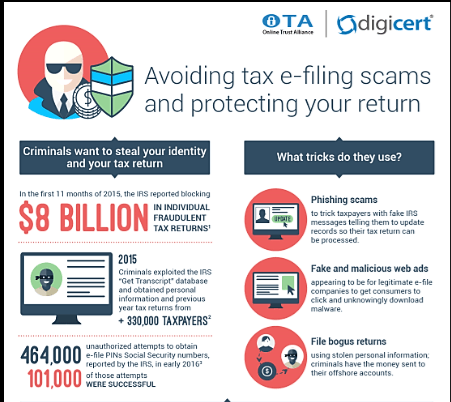

E filing 2016. Late payment penalties apply until you have paid all your taxes. Washington the internal revenue service today reminded people including those in disaster areas who want to file a 2016 tax return electronically to do so by saturday nov. You can still file 2016 tax returns.

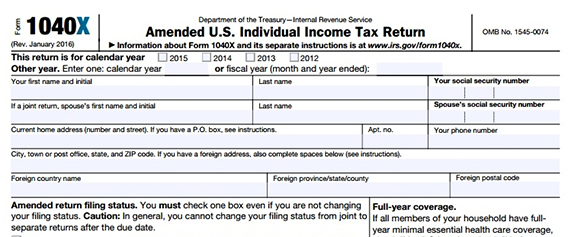

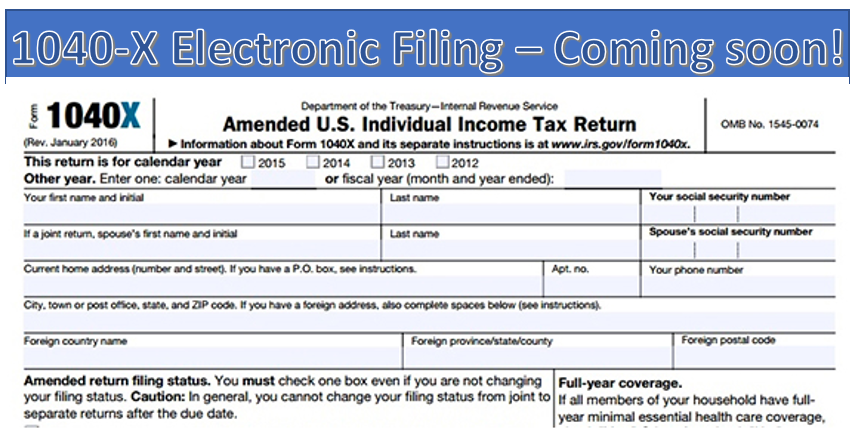

For tax year 2016 e file closes on nov. For businesses and other taxpayer audiences see the links to the left. You can no longer efile a 2016 federal or state income tax returns mail in instructions are below.

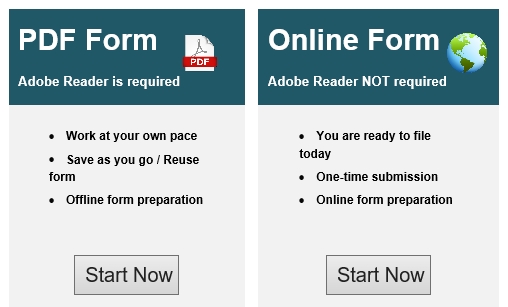

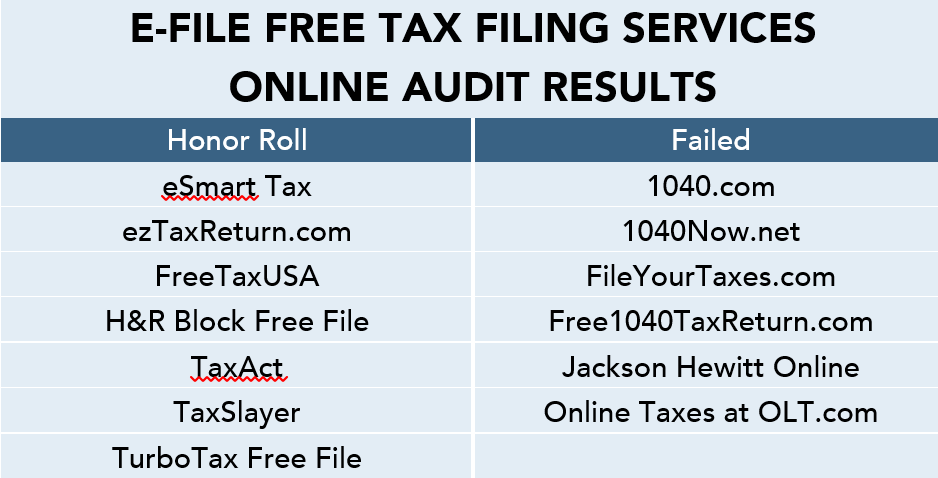

Even though the deadline has passed you can file your 2016 taxes online in a few simple steps. Four electronic filing options for individual taxpayers are listed below. File late taxes today with our maximum refund guarantee.

All available prior years. After an evaluation of the pilot project the court concluded in early 2016 that statewide e filing would best be supported by continuing to develop a customized and uniform case management system provided by the court. Navigate to the e file tab click response to outstanding tax demand to view the tax demand or click e pay tax to generate the pre filled challan for payment login to e filing account.

Prepare and efile your 2020 taxes by april 15 2021 or until oct. If you owe taxes you will face a late filing penalty unless you filed unless you efile a tax extension by april 15 and efile by oct. If you need to prepare a return for 2014 2015 or 2016 you can purchase and download desktop software to do it then print sign and mail the return s.

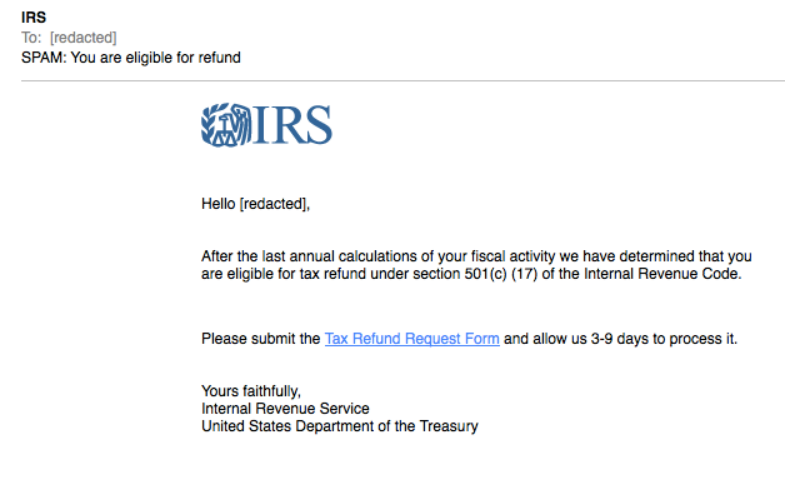

After that disaster victims others need to file on paper. Sars efiling is a free online process for the submission of returns and declarations and other related services. To file a return for a prior tax year only a 2017 return can be prepared online and e filed.

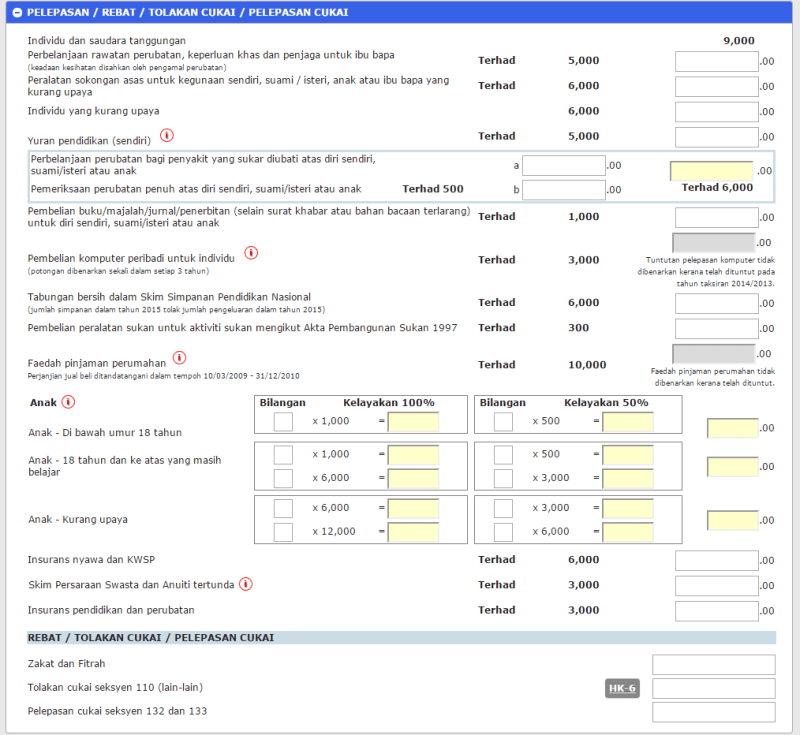

After e filing shuts down for the current tax year we re working hard to get things ready for the upcoming tax year. E filing aplikasi e filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar borang nyata cukai pendapatan bncp dan borang anggaran secara dalam talian. If you still need to file your 2017 2018 or 2019 tax return see these instructions for paper filing your return.

Welcome to the new sars efiling landing page. Our online income tax software uses the 2016 irs tax code calculations and forms.

.png)