E Filing Fasa 2

In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions.

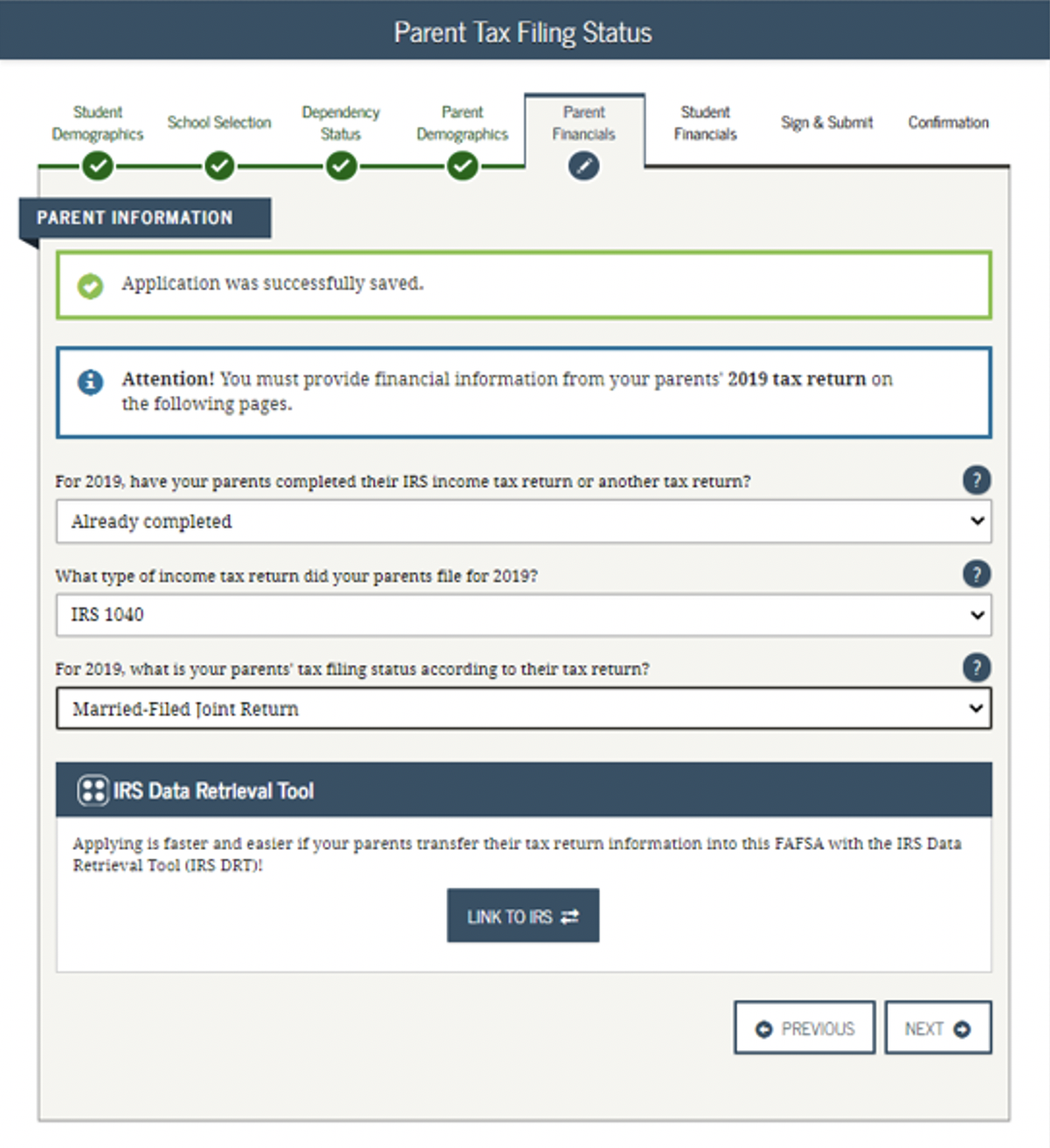

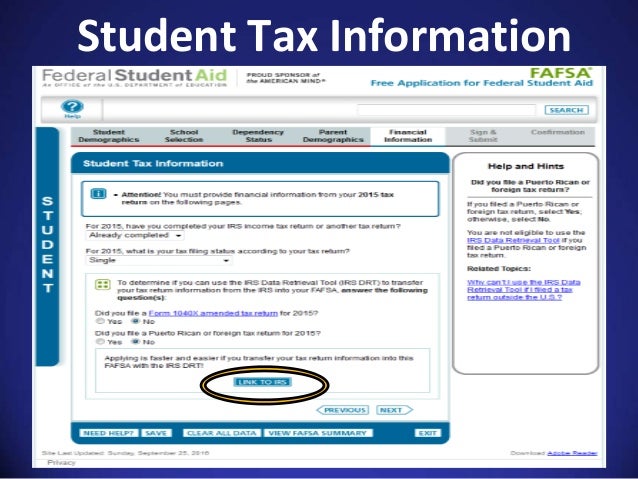

E filing fasa 2. In this case you can t submit just one fafsa with two students in college. The fafsa is the key to getting federal financial aid so it s crucial to file it correctly. You must provide a copy of your forms w 2 to the authorized irs e file provider before the provider sends the electronic return to the irs.

Mytrustid desktop windows os mytrustid desktop mac os manual mytrustid desktop windows os manual mytrustid desktop mac os soalan lazim. Due to the covid 19 pandemic our bso customer service and technical support staff is currently limited and hold times on the phone may be longer than usual. File search for the court of appeal and the federal court can be only made for registered cases under e filing starting from 10th of july 2017.

Paparan dokumen dalam sistem e filing mulai 15 oktober 2020 pihak pihak akan dapat melihat paparan dokumen kertas kausa enclosures yang difailkan di mahkamah sama ada dokumen tersebut adalah dokumen yang difailkan sendiri ataupun yang difailkan oleh pihak lain dalam ruangan butiran pemfailan atau semasa sesi e review. You may be one of them. After filing retain a copy of the forms for your records.

Governed by the florida courts e filing authority. Rayuan bayaran fasa 2 semakan status permohonan baru dan kemas kini id wakil semakan status dan pembayaran fasa pertama bsh 2020 pendaftaran mybsh 2020 bayaran fasa 3 waris dan skim khariat kematian. Syarat permohonan jadual pembukaan kaunter bsh 2020.

Soalan lazim pembaharuan pki. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions. If you need immediate assistance our toll free number is 1 800 772 6270 tty 1 800 325 0778 and is available monday through friday 7 a m.

Instead you must submit a fafsa for each child who s in school. File a separate fafsa for each child. If your or your family s financial situation has changed significantly from what is reflected on your federal income tax return for example if you ve lost a job or otherwise experienced a drop in income you may be eligible to have your financial aid adjusted.

Log on to e filing portal at https incometaxindiaefiling gov in.